3PL Warehousing Trends for 2022

As we chug along into the first quarter of 2022, the trends we observed last year continue to play out. Supply chain and logistics remain hot topics globally and even more so in recent weeks as the conflict in Ukraine and Eastern Europe evolves. The impacts of these trends can be significant. So it is important to be proactive and plan accordingly.

It’s everywhere. Have you eaten out lately? If you can even get a reservation, dining rooms are half open and service is lacking. With the unemployment rate currently at 3.8%, the problem is only getting worse. Warehousing has been hit harder than other industries. With unemployment low “easier” jobs are found elsewhere. But 3PLs need workers. We’ve heard stories of 3PLs offering significant signing bonuses, referral awards, free lunches, and even flex hours. (Also see the ad from Amazon.) Companies will continue to find creative ways to hire and keep workers.

eCommerce Fulfillment

eCommerce is still white-hot, growing at over 33% last year with no signs of slowing. Although online spending accounts for less than 15% of total retail sales, consumers have grown accustomed to the convenience and speed of shopping online. Traditional pallet-in/pallet-out 3PLs have been forced to expand into eCommerce fulfillment services.

In addition to quicker order processing times and more efficient picking processes, 3PL warehouses are now required to have more connected systems to manage orders and data. EDI and API are new to many warehouses, which requires a new skill set in staffing. Investment in people and technology is a must.

Automation and Robotics

Although some robotics technologies like fully autonomous delivery systems are still a way off, we are seeing a lot more robotics applications and automation in the warehouse. The increase in the use of robotics is partially a result of the lower total costs associated with implementing and operating the technology. With few options for the ongoing labor shortages, smart 3PLs are embracing robotics now.

If an automated pick system like 6 River Systems can eliminate the need to hire 3 to 4 workers, the expense more than pays for itself. In addition, many automated systems are Robotics as a Service (RaaS) which allows you to “rent” systems and avoid big capital expenditures. We are also seeing investments in other cost-saving technology such as finger scanning, automated palletizers, layer picking, and semi-automated forklifts.

Integrated Systems

While productivity improvements in the physical movement of goods is imperative, another major trend is the need for supply chain systems integration i.e. the data behind the physical flow of goods. Visibility of the entire supply chain means more flexibility in space and demand planning and additional cost savings in today’s fast-paced world. Transportation Management Systems (TMS) and Warehouse Management Systems (WMS) are working together to streamline processes and eliminate unnecessary costs.

Shipping Capacity is Tight

Demand for transportation services is high. Capacity is stagnant. Not only are drivers in short supply, but we are also seeing more transportation companies getting into the warehousing business. With this increased demand and short supply, rates will continue to increase. Shippers are looking for innovative ways to leverage technology to optimize their shipping options. The adage Speed, Quality, Cost – Pick two is an everyday exercise.

Information Overload

With all this data being generated inside and outside of the warehouse, 3PLs need to have the technology to analyze and track data. Where are the highest cost centers in the warehouse? Are there inefficiencies that can be improved with better inbound receipts? Does it make sense to open another warehouse or partner with another 3PL? Warehouses will continue to need faster access to better, more actionable information. Shippers are looking to 3PLs to help them make decisions.

Cold Storage Warehousing

The global cold storage warehouse market is expected to grow at an annualized rate of 13.5% (CAGR) from 2021 to 2028. 3PLs (public warehousing) accounts for around 75% of the gross capacity. The US accounted for 36% of global revenue in 2020. of Many factors are attributed to the high growth. (Grandview Research)

Consumers are ordering more perishable items online. Online grocery has grown exponentially over the last couple of years. The increased demand means new warehouses and distribution centers closer to large cities – a trend with non-cold storage as well.

There is also a growing need for cold storage in the pharmaceutical industry. We had the obvious surge in cold storage requirements with COVID vaccines but with advancements in health care, other pharmaceuticals and injectables also need special handling.

Frozen vegetables, fruit, fish, meat, seafood, and other products continue to grow in demand. Have you been to Costco in a while? The frozen food area is 3x the size of fresh produce, which also needs refrigeration, by the way!

Warehouse Demand Exceeds Supply

Warehouse vacancy is at an all-time low at 3.6%, which equates to about 300 million square feet, according to CBRE. (ABC News). Some areas of the country are below 1%. Capacity is being added but not fast enough. Some companies are even dealing with the scarcity by signing leases before ground is even broken.

In addition to eCommerce growth, another reason for the increase in demand is that companies are leasing more space than they need (some more than 50%) in anticipation of increased demand. They would rather make less margin today than risk running out of space in the future. This trend will continue until supply catches up with demand (if it ever does).

Smaller, Urban Warehouses

As the US population continues to move into urban areas and increase online spending, the need to have inventory closer to the consumer will continue. The current solution is a greater number of smaller, urban warehouses. Not only does this cut down on shipping costs, it also means faster delivery times to satisfy the instant gratification of online customers.

With inventory scattered in more warehouses, the need for accurate information about the inventory is high. A robust warehouse management system and proper demand forecasting should be a top priority for suppliers in this sector.

Smaller warehouses also require more optimized use of space. We are seeing trends in the use of multi-story buildings to optimize vertical space in urban warehousing. This presents a whole new set of challenges in the movement of goods.

Other Risks are Increasing

On top of all the trends previously mentioned, there are several other factors that will increase risks for 3PLs. Some of these are not new. However, the probabilities are increasing, requiring more proactive analysis and planning. As we saw during the pandemic, major changes can happen quickly.

While we hope the chances of it happening again are less, the Ever Given container ship getting stuck in the Suez Canal caused catastrophic problems, costing an estimated $10 billion a day in trade. We can’t predict such events, but we can have backup plans in place for other similar bottlenecks.

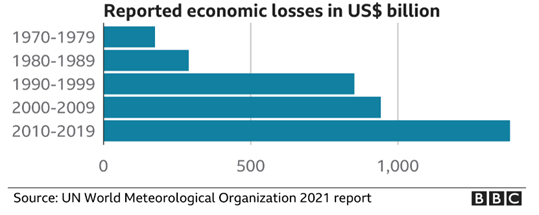

Whether you agree or disagree that global warming is happening, the data shows the impact of weather-related economic losses has increased (see chart). Droughts, flooding, and extreme weather will continue to impact the logistics industry and the world economy.

And then there are energy prices. Not only do we have to be aware of moves in Federal policies related to en+ergy production, but we are also now facing global conflicts that are significantly affecting prices. These risks will continue.